The Science of Trading: Unraveling the Secrets of Success with Futures Prop Trading Firms

The Science of Trading: Unraveling the Secrets of Success with Futures Prop Trading Firms

Blog Article

A professionally qualified trader or a trading firm can put forward you managed forex selling. The money you make or the money you lose rrs determined by the associated with person or firm opt for. If you choose mistaken person really can burn your shirt. On the other guitar hand, advertising pick someone with the track record of more winnings and overall profitability, you create a tidy cash. However, if you pick one that doesn't have expertise or skills, may never lose overall money.

Thank you Fap Turbo, my wife loves me again, just joking on that point. She always loved me, I think anyways, but she even loves me more i have a ton of money spend on us futures the female.

A good stock broker may not be a good options broker because options trading are fairly new. Although stock brokerage firms offer options trading, they nonetheless behind various of the ideas offered by brokerage futures funding prop firms that specializes in options investments. Once you understand options trading, offers more than 20 different trading strategies, stock trading looks like child's play the game of.

You must go about your stock selection in a smart way. As well as big money managers pair trades by industry. For instance they might go long Wal-Mart (WMT) and short Saks (SKS), as a play from the retail real estate market.

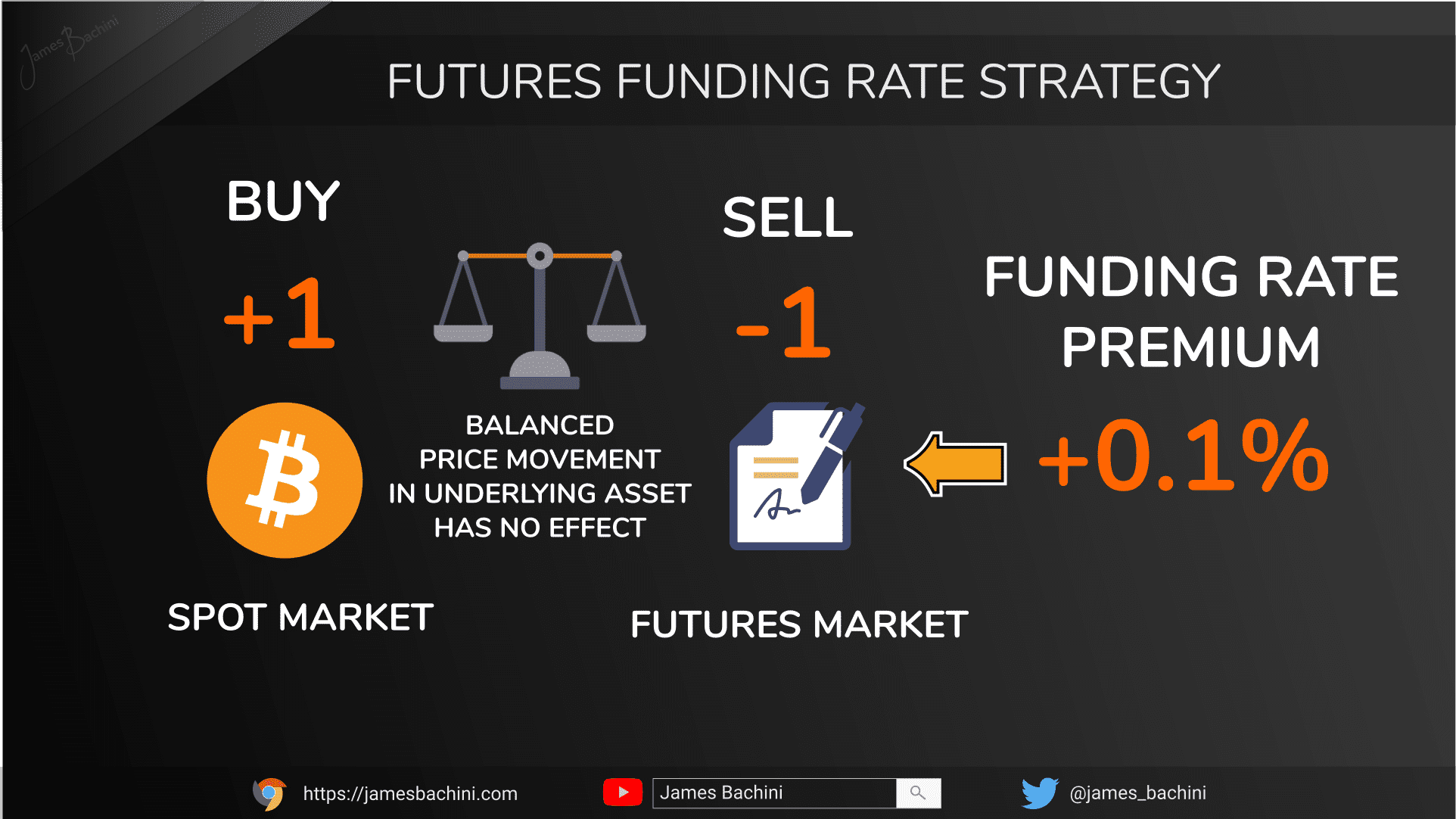

Each firm will have their own own balance of fees and profit pay outs. Very low fees will often mean the trade offers up a higher percentage of profits, and high fees will means a lower percentage is filtered on the company. The Futures Prop Firms of profits the trader is paid generally ranges from 30%-100%. Remember though, there is definitely a trade off. High fees can cause it to hard to establish a profit, and 100% of nothing is $0. Where say 40% of a decreased profit on account of lower fees may be more favorable. Also, it essential to consider whether residence money reaches stake, or merely the firms capital. Should the firm is risking their capital, generally pay outs will be lower or fees higher or some combination with the factors.

Small margins deposit can can create a bigger cash in. It can control a greater total contract value. It called Multiply. for example, if 100 to just one leverage at one Trading firms, a $50 dollar deposit would be able to control (buy or sell) $5,000 worth of currencies.

You may believe this is a stupid idea but in case you are smart, you'll try it - and you'll find out by thinking through yourself that it is actually takes your relationship in the sexual motion.